does texas have an estate tax

However a Texan resident who inherits a property from a state that does have such tax will still be responsible. The good news is that texas doesnt impose an estate or inheritance tax.

Opinion Rich Kids Can Spare Some Of Their Inheritance The New York Times

Does Texas have an estate tax.

. When someone dies their estate goes through a legal process known as probate. The good news is that texas doesnt impose an estate or inheritance tax. An estate tax is similar to an inheritance tax in that both are imposed.

The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Some states have estate taxes too. As long as the estate in question does not have assets exceeding.

However Texas is not one of those states. On the one hand Texas does not have an inheritance tax. Texas does not have an estate tax and the.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. The state repealed the inheritance tax beginning on sept. But according to one.

Homestead tax credit towards up to 1168. Texas Inheritance Taxes and Estate Taxes. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005.

The state sales tax rate in Texas is 625 percent. If an estates value surpasses that amount the top federal tax rate is 40. Wisconsin does have several tax credits available.

Most Americans will never have to pay a dime in estate tax because the federal government exempts all estates worth less than roughly 12 million. A Closer Look The Matter of Texas Probate Taxes. While Texas doesnt have an estate tax the federal government does.

So until and unless the Texas legislature changes the law. The estate does not own real estate other than the decedents home. Fortunately Texas is one of the 33 states that does not have an inheritance tax.

Therefore Texans will only have to worry about the federal estate tax on their properties. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for. The state of Texas does not have an estate tax however residents may still be subject to federal estate tax laws.

The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal. Theres more good news. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Death Taxes in Texas. The state repealed the inheritance tax beginning on sept. Assume your estate is valued at 1536 million and you have no spouse.

The estate does not own real estate other than the decedents home. Earned income tax credit worth up to 13 of your federal earned income tax credit. When someone dies their estate goes through a legal process known as probate.

After deducting the 1206. At one time Texas did have an inheritance tax but it was repealed. Texas has neither an inheritance tax nor an estate tax.

If you live in Texas and are thinking about estate planning. This means that any estates that are valued over 117 million dollars will be taxed before any assets are. Definition of Estate Tax.

But according to one. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

Estate Tax Texas Aglaw Blog Towntalk Radio

/cloudfront-us-east-1.images.arcpublishing.com/dmn/XON2HRNKLFDBLM6ZDNGOYDTUVQ.png)

Death And Taxes The Imperiled Federal Estate Tax Exemption

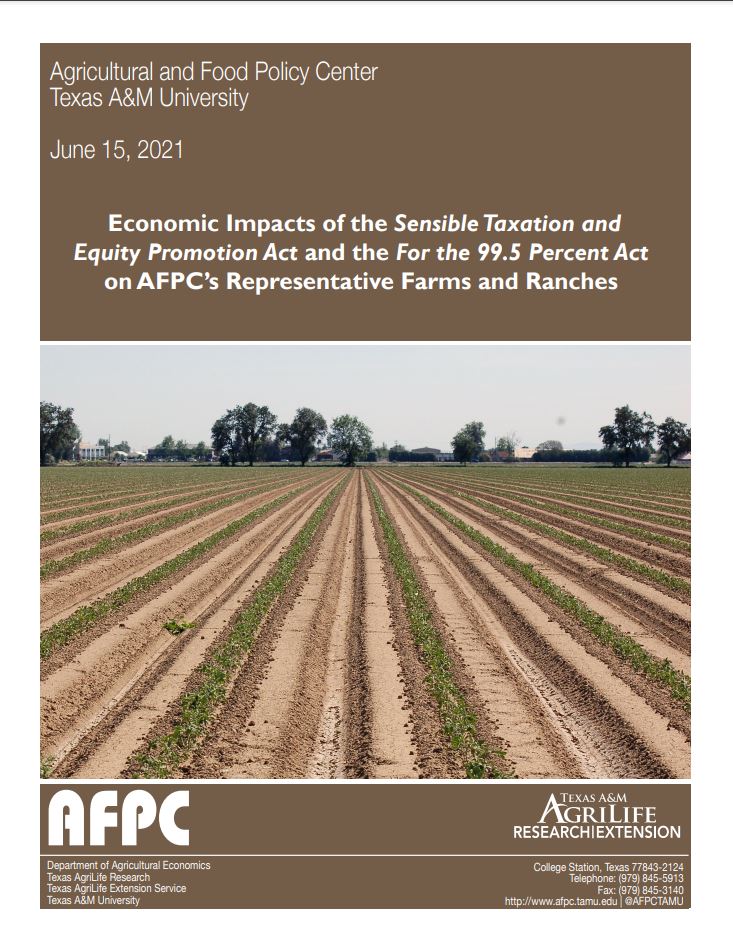

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

Thomas Walters Pllc Legal Blog

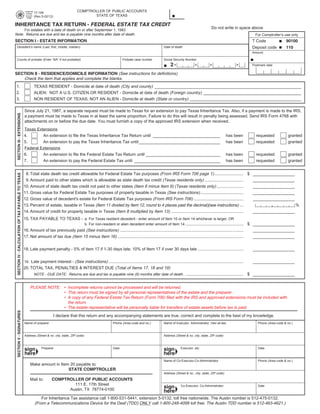

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Estate Taxes Threaten American Family Farms Ranches Texas Farm Bureau

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Texas Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Top Ten Reasons The U S House Will Kill The Death Tax

Estate And Inheritance Taxes Urban Institute

Does Every Estate Have To Pay An Estate Tax Rania Combs Law Pllc

Estate Tax Category Archives Houston Estate Planning And Elder Law Attorney Blog Published By Houston Texas Estate Planning And Elder Lawyers Mcculloch Miller Pllc

Property Tax In The United States Wikipedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Texas Estate Tax Everything You Need To Know Smartasset

How Do State And Local Property Taxes Work Tax Policy Center